Bankruptcy and Student Loans: A Comprehensive Guide

Navigate the complexities of bankruptcy and student loans with this comprehensive guide. Understand federal laws and practical steps for consideration.

Federal Laws

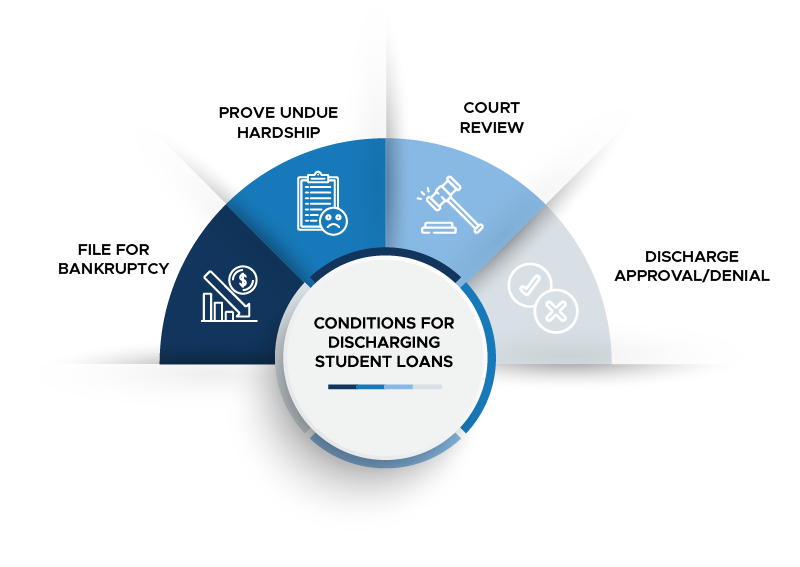

Under 11 U.S. Code § 523, student loans are generally nondischargeable in bankruptcy unless they meet the "undue hardship" criteria.

Steps for Consideration

-

Gather all loan documentation, including loan agreements and payment histories.

-

Explore various repayment options available to you.

-

Understand the implications of declaring bankruptcy on your student loans.

Hypothetical Scenarios

Emily was burdened by overwhelming student loan debt and other financial obligations. While we couldn’t discharge her student loans through bankruptcy, we successfully eliminated her other debts. This freed up her income, allowing her to make more substantial payments towards her student loans.

Mark was already applying for student loan forgiveness when he filed for bankruptcy. Although the bankruptcy itself did not lead to the forgiveness of his student loans, eliminating his other debts made it easier for him to meet the requirements for the forgiveness program, which he eventually received.

Sarah believed her student loans would be a lifelong burden. However, by filing for bankruptcy, we could discharge her other debts, such as credit card balances and medical bills. Receiving a discharge of her other debts allowed her to enroll in a more manageable repayment plan for her student loans, giving her the financial reset she needed.